A FINANCIAL WHIZ-KID DESCRIBES HOW WE CAN ALL RISE FROM THE FINANCIAL ASHES

JOHN McNAMEE EXPLAINS….

It was a blisteringly hot Code Red day in February 2014 and the bushfires continued to rage.

Scott Pape was with his fellow volunteers from Victoria’s hard-pressed Country Fire Authority trying vainly to stop the widespread rush of flames from reaching properties around the Romsey area, near the Macedon Ranges.

They were the worst conditions since the devastating bushfires of Black Saturday, February 2009, which claimed 173 lives and destroyed hundreds of homes.

The fire had reached the outer perimeter of Scott’s sheep property and was heading towards his paddocks of livestock and homestead.

His wife and baby son had fled from the farm in the family car the previous day car with just a few possessions and several sheep dogs.

“As we looked down the ridge towards my sheep farm, all I could see were dense clouds of black smoke and spot fires everywhere,” Scott told Go55s.

“The CFA captain said to me: Go and get in your car now, and get out of here before it’s too late.

“So I did and he was right.

“The next day my wife Liz and myself and our 12-month-old son Louie drove back down the road towards our place. It was heartbreaking.

“There was nothing left…the house and all our belongings had gone, including our wedding treasures and the boy’s toys. It was a huge kick in the guts.

“We could see in the paddocks that hundreds of sheep had been burnt to death.. some were still wandering around dazed with smoke coming off their backs..they had to be put down.

“Miraculously our two alpacas Alberto and Pedro had survived although their hooves were so badly burned they had trouble standing upright,” Scott said.

There was another lucky survivor among the smoking ruins. The big old gumtree under which Scot and Liz were married two years before had defied the flames.

But the overall destruction did not send the 35-year-old financial whiz-kid or his family into the depths of despair.

Two years on, Scott and his family have rebuilt their property at Romsey and have welcomed another son, Eddie, into their lives.

The former stockbroker and financial expert was able to turn the near-tragedy into a major positive.

He has just released his second book, The Barefoot Investor..The Only Money Guide You’ll Ever Need.

And for someone like myself whose grasp of matters financial is sketchy to say the least, it’s a rollicking good read with a lot of common sense money advice underlying it all.

Scott says it was the attitude of those two alpacas which refused to lie down and die and despite their obvious pain, continued to circle protectively around the remaining flock of burnt and traumatised sheep.

“It put the whole thing into perspective for me and just like the fire authorities have an action plan, so too do we in our financial planning.

“As I say in my book, you need to kick off the shoes and tread your own path. (Hence the barefoot epithet.) Whatever your age or circumstances you need a fire plan. You have to become financially fireproof.

“It may be just paying off the house mortgage before you retire, or coming up with a savings scheme.

“You need to take these steps because you never know what could happen in your life. It could be an unexpected early retirement or a health problem or a marriage breakup.”

Scott’s first book also called the Barefoot Investor was a runaway best seller about 10 years ago and was aimed at the younger person.

“I found out that the mums and dads were reading it too and taking its advice so I always planned to bring out another one,” he said.

In this latest recently released volume, Scott deals with such issues as The Superannuation Myth -Why You Don’t Need $1 million to retire….a concept he calls the Don Bradman Strategy.

Other topics covered in Scott’s engaging down-to-earth almost “jokesy” writing style are: Teaching kids the value of a buck (in this age of plastic cards and electronic transfers); How to Save on your mortgage; how to save up a six-figure house deposit in 20 months and how to turn getting out of debt into a game you’ll win (and enjoy).

But it was the book’s chapter on retirement that took my interest especially .

Scott describes his Golden Rule for people coming to the end of their full-time working life: Keep working.

“That doesn’t mean you have to keep your existing job (especially if you’re a tiler with dodgy knees.)

“You can do something less labour intensive – just a day or so a week and it doesn’t need to be every week.

“Work is good for you: retirees who continue doing some kind of part-time work are found to be the happiest and the least likely to suffer depression.

“For example, I meet so many Uber drivers who are well-to-do retirees who don’t need the money….they just like chatting to people and earning their keep at the same time.”

Scott’s book also explains the Three-Bucket Retirement solution or how to manage your “buckets” before you kick the bucket!

“When you retire you’re going to be operating your buckets from within your superannuation.

“You’ll have a Blow Bucket for everyday expenses which you’ll access with your everyday transaction account.) And feeding this in part will be pension payments from your Grow Bucket.

“Then there’s your Mojo Bucket or safety money which could give you three to five years of money socked away which is going to stop you from having a lot of sleepless nights when the markets get rocky.

“Actually a lot of the big funds hate me because I refuse to address their conventions and I don’t take any money from them …I’m fiercely independent and I’m highly critical of the huge fees extracted by the big firms.

“As I’ve said before…there are lots of yachts, Ferraris and mansions in the superannuation business….but they’re all in the hands of the fund managers, not the investor,” he says.

Apart from his highly successful Barefoot Investor online newsletter, Scott who has a post-graduate degree in financial planning from Melbourne University, syndicates advice columns for News Corps newspapers and has regular spots on Triple M radio and Channel 7.

He’s also employed by the Australian Government to conduct financial education in more than nine thousand schools.

“With kids, I like to explain the Three Jam Jar strategy…Spend, Save and Give….because it gives them an understanding of money and how to handle it,” Scott says.

“It’s something I’ll soon be teaching to my own kids too I suppose,” he laughs.

- The Barefoot Investor…The Only Money Guide you’ll ever Need by Scott Pape is published by Wiley. RRP $29.95.

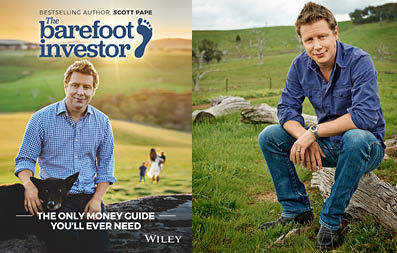

Main pic lfet: The cover of the book showing the author with his beloved sheepdog black betty

Right: Author and financial whiz-kid Scott Pape on his Romsey sheep farm